For example, if a company’s current assets are $80,000 and its current liabilities are $64,000, its current ratio is 125%. However, if the current ratio of a company is below 1, it shows that it has more current liabilities than current assets (i.e., negative working capital). If the current ratio of a business is 1 or more, it means it has more current assets than current liabilities (i.e., positive working capital). In other words, it is defined as the total current assets divided by the total current liabilities.

- ” observed 19,646 Brazilian futures contract traders who started day trading from 2013 to 2015, and recorded two years of their trading activity.

- Large retailers can also minimize their inventory volume through an efficient supply chain, which makes their current assets shrink against current liabilities, resulting in a lower current ratio.

- Company C is more liquid and is better positioned to pay off its liabilities.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- A high ratio implies that the company has a thick liquidity cushion.

How we make money

In its Q fiscal results, Apple Inc. reported total current assets of $135.4 billion, slightly higher than its total current assets at the end of the 2021 fiscal year of $134.8 billion. However, the company’s liability composition significantly changed from 2021 to 2022. At the end of 2022, the company reported $154.0 billion of current liabilities, almost $29 billion greater than current liabilities from 2021.

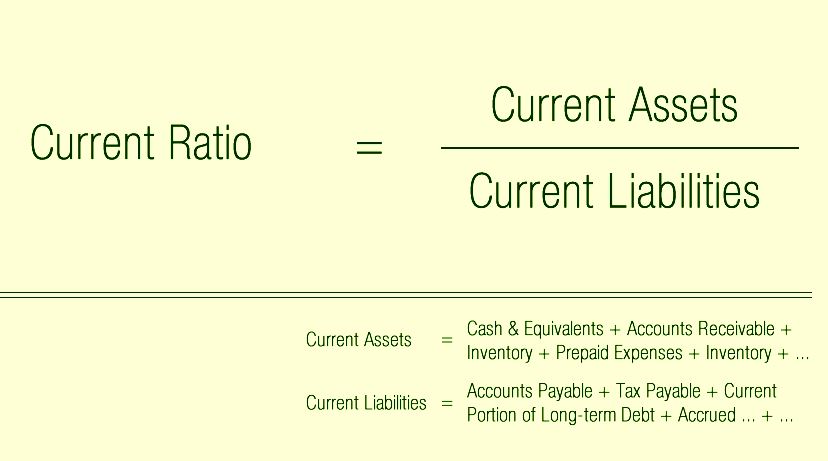

How do you calculate the current ratio?

It’s a simple ratio calculated by dividing a company’s current assets by its current liabilities. Current assets include cash, accounts receivable, inventory, and any other assets expected to be converted into cash within a year. Current liabilities, on the other hand, are debts and obligations due within the same timeframe.

Current ratio vs. quick ratio vs. debt-to-equity

One fundamental indicator probably won’t rock your trading world. I already explained how you can use them for trading, but long-term investors read and interpret them slightly differently. Fundamentals are often overlooked, but they can tell you a lot about a company over time. But it’s good to understand how it works and what it could mean. To give you an idea of sector ratios, we have picked up the US automobile sector. This account is used to keep track of any money customers owe for products or services already delivered and invoiced for.

How is the Current Ratio Calculated?

The quick ratio demonstrates the immediate amount of money a company has to pay its current bills. The current ratio may overstate a company’s ability to cover short-term liabilities as a company may find difficulty in quickly liquidating all inventory, for example. Both ratios include accounts receivable, but some receivables might not be able to be liquidated very quickly. As a result, starting a bookkeeping business even the quick ratio may not give an accurate representation of liquidity if the receivables are not easily collected and converted to cash. When you do that, you see that liquidity ratios are based on a borrower’s ability to pay off its short-term (or current) debt with its current assets. I have compiled below the total current assets and total current liabilities of Thomas Cook.

Ask a Financial Professional Any Question

Sometimes these tiny companies only have one or two current asset accounts. Short-term obligations are generally classified as due within one year. There’s a decent chance you’ve heard of the current ratio — and other liquidity ratios. People look at fundamentals and SEC filings and just blow them off cause they’re boring.

Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. It’s limited to only current debt and asset and short-term needs. From the above table, it is pretty clear that company C has $2.22 of Current Assets for each $1.0 of its liabilities. Company C is more liquid and is better positioned to pay off its liabilities. This includes all the goods and materials a business has stored for future use, like raw materials, unfinished parts, and unsold stock on shelves.

It helps investors, creditors, and management assess whether a company can comfortably navigate its short-term financial waters or if it’s sailing into rough financial seas. It’s a key indicator in the world of finance that’s worth keeping an eye on to make informed decisions about a company’s financial stability. The current ratio is a fundamental financial metric that provides valuable insights into a company’s short-term financial health.

Other measures of liquidity and solvency that are similar to the current ratio might be more useful, depending on the situation. For instance, while the current ratio takes into account all of a company’s current assets and liabilities, it doesn’t account for customer and supplier credit terms, or operating cash flows. The current ratio shows a company’s ability to meet its short-term obligations. The ratio is calculated by dividing current assets by current liabilities. An asset is considered current if it can be converted into cash within a year or less, while current liabilities are obligations expected to be paid within one year.

Recent Comments